What Is a Signature Loan?

A signature loan – occasionally referred to as a good faith loan, is an unsafe personal loan that requires nothing other than the signature of the borrower as a pledge that will repay the obligation. Unlike securing a mortgage or auto loan using collateral for approval, this type of loan is based basically on creditworthiness – which involves the score and the income ratio of debt against income.

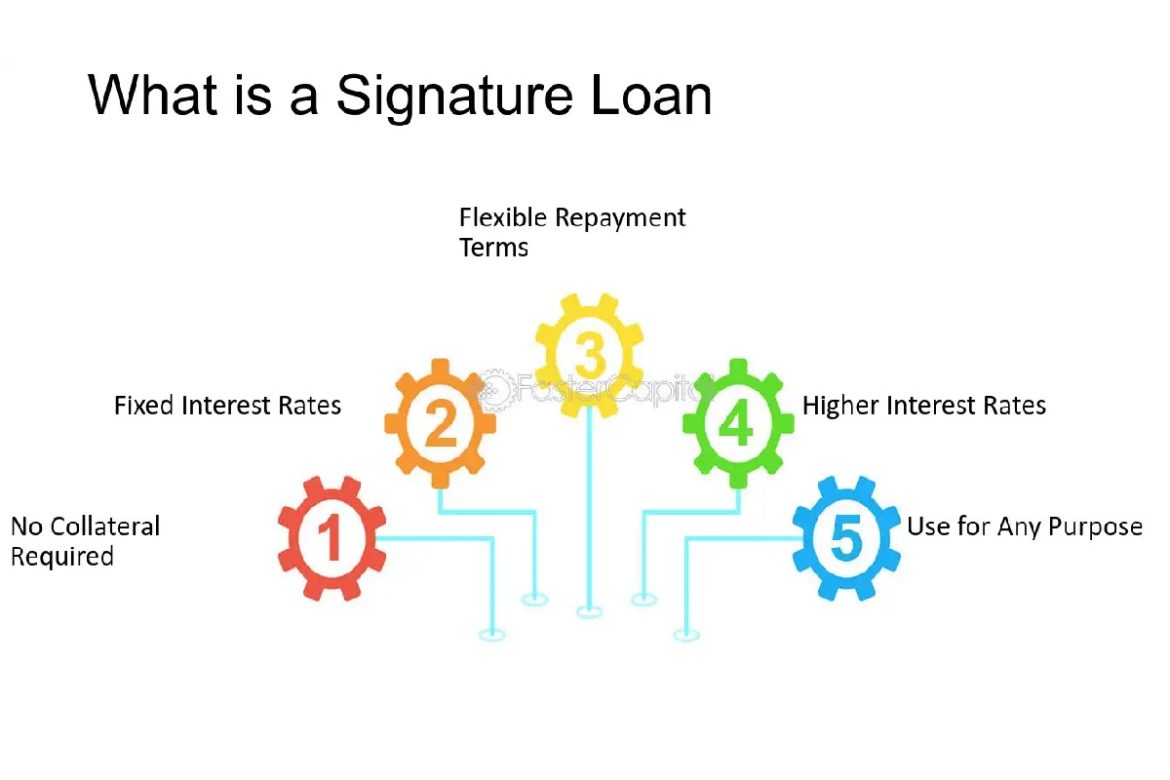

Key Characteristics of a Signature Loan

- Collateral Free Nature:

Signature loans do not demand collateral. So, there’s no need for borrowers to pledge an asset such as a car or house. As there is no collateral, the lender takes on more risk and often charges an extreme interest than a secured loan.

- Fixed Amount and Term of Loan:

The amount lent must be repaid through fixed installments over a definite period, usually within one to five years.

- Flexible use of funds:

You can use these loans to pay off significant debts or home improvement costs, for medical expenses, or as an advance for a big purchase.

- Credit-based approval

The lender will check up on your credit merit and his interest rate. The primary meaning of a good credit score is better terms.

How a Signature Loan Works

- The Application Process: Borrowers apply to banks, credit unions, or online lenders based on their personal information along with proof of income and possibly employment details

- Approval: It is based on the history of credit repayment, income stability, and the capacity of the debtor to repay

- Disbursement: Once approved, the loan amount gets disbursed in one go, directly sent to the applicant’s bank account

- Repayment: The loan amount should be repaid in fixed monthly portions over the agreed-upon term. The credit scores are negatively affected by Late or missed payments.

Pros and cons of a Signature Loan

Advantages:

- No Collateral Needed: Debtors don’t risk losing personal assets.

- Access to Cash in a Shorter Time Frame: Application and approval processes are typically faster than secured loans.

- Flexibility to Use: Cash can be applied to nearly any financial need.

Disadvantages:

- Complex Interest Rates: Because collateral is absent, there is more risk to the lender, and hence, interest rates will be high.

- Credit Hope: Borrowers with low credit scores may struggle to get approved or will get unfavorable terms.

- Permanent Repayment Terms: They are predictable yet less flexible, which some borrowers find restrictive.

Who Should Consider a Signature Loan?

- Debt Consolidators: Those seeking to roll multiple debts into one payment with possibly lower interest rates.

- Emergency Expense Managers: Those facing unexpected financial burdens, such as medical bills or urgent repairs.

- Consumers With Strong Credit: Those with good credit can secure competitive rates and terms.

Alternatives to Signature Loans

- Secured Loans: Options like home equity or auto loans recommend lower interest rates but need collateral.

- Credit Cards: Credit cards are a more precise option for small purchases if handled responsibly.

- Peer-to-Peer Lending: Online platforms equivalent borrowers with individual investors, supporting another avenue for unsecured loans.

Conclusion

A signature loan may be an excellent solution for one who wishes to raise quick Cash without collateral. However, they must know where they stand financially and compare the terms to meet their needs. Shop around for the best interest rates and repayment terms for sound decisions.